IBPS Clerk 2020-21 Exam

IBPS (Institute of Banking Personnel Selection) conducts a common written exam or CWE every year for the clerical cadre in multiple banks all over the country. All public sector banks use CWE as a base to fill the vacancies for this post.

IBPS is conducting Clerk exam for the eighth year now and hence named IBPS Clerk CWE IX. The IBPS Clerk CWE exam is conducted on two levels- preliminary exam and mains. Students qualifying in both these exams are thus selected for the post.

IBPS Clerk 2020-21 Exam Dates

You must note down important dates related to IBPS Clerk Exam 2020-21 and make sure that you complete the process correctly on time. The schedule of the exam is mentioned below:

| Activity | Dates |

|---|---|

| Online Application Starts From | 23.10.2020 |

| Last Date to Apply Online | 06.11.2020 |

| Conduct of Pre-Exam Training | 23.11.2020 to 28.11.2020 |

| Download of Admit Card for Online Examination – Preliminary | 18.11.2020 |

| Conduct of Online Examination – Preliminary | 05.12.2020, 12.12.2020 and 13.12.2020 |

| Result of Online Exam – Preliminary | 31.12.2020 |

| Download of Call letter for Online Exam – Main | 12.01.2021 |

| Conduct of Online Examination – Main | 24.01.2021 |

| Declaration of Final Result | 01.04.2021 |

IBPS has notified the notification for the recruitment of Clerks.Give your best and we, A A SHAH’s Young IAS, will help you all with every step you take. Read the notification carefully for details regarding eligibility criteria and exam pattern.

Full Notification

IBPS Clerk Eligibility Criteria – 2020-21

Nationality / Citizenship:

Candidates applying for IBPS CWE/Bank Clerk Examination should be one of the following:

1. Citizen of India

2. Subject of Nepal or Bhutan

3. Tibetan Refugee who came to India before 1st January 1962 with the intention of permanent settlement

4. Person of Indian Origin (PIO) who has migrated from Burma, Pakistan, Sri Lanka, Vietnam or East African countries of Zaire, Kenya, Tanzania, Uganda, Zambia, Ethiopia, Malawi, with the intention of permanent settlement in India Candidates belonging to the category 2, 3, 4 must have a certificate of eligibility issued by the Govt of India in their favour.

Age : (As on 01.09.2020):

Minimum: 20 years Maximum: 28 years

i.e. A candidate must have been born not earlier than 02.09.1992 and not later than 01.09.2000 (both dates inclusive)

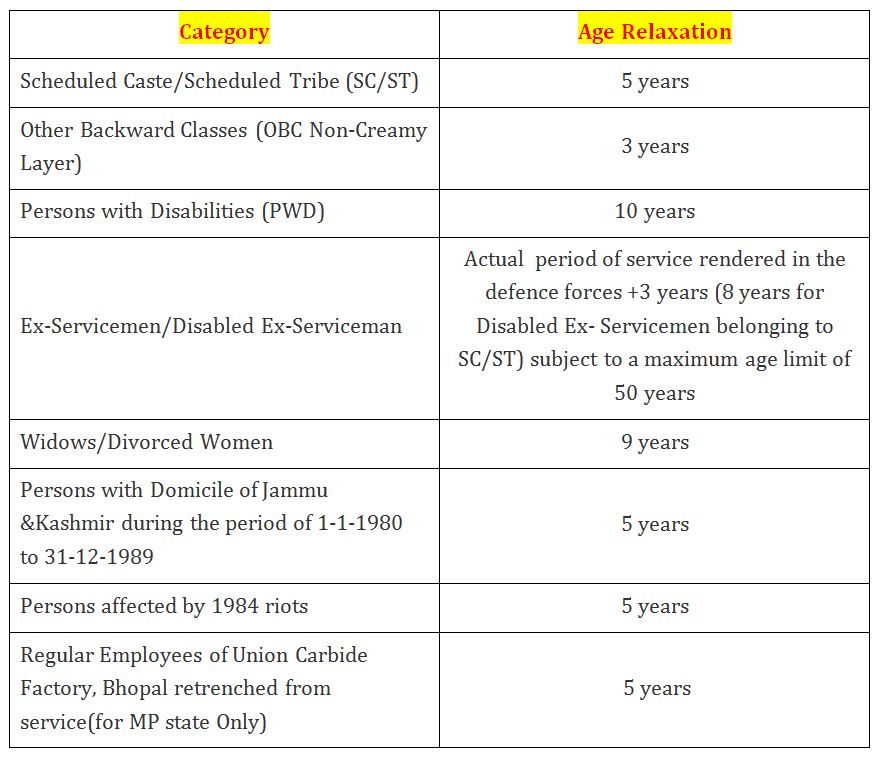

Age Relaxation

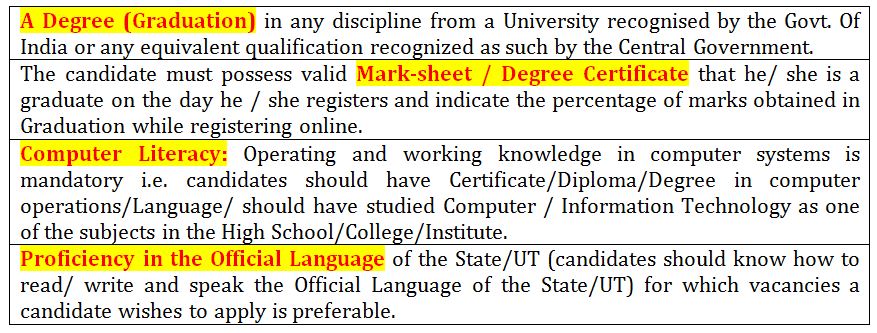

Educational Qualification

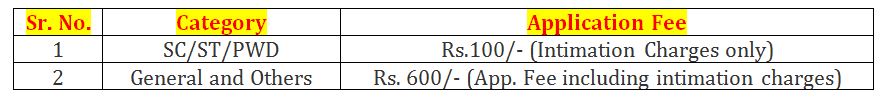

IBPS CLERK APPLICATION FEE

IBPS CLERK EXAM PATTERN

Phase-1: IBPS Clerk Preliminary Examination

The preliminary exam of IBPS Clerk CWE is an online exam testing a candidate on the basis of their aptitude, intellect and English. There are three sections in total and the candidate must clear the cut off of each section to proceed to the mains exam round.

Candidates are required to solve the question paper in the time frame of 20 minutes for each section. The composite mark of the paper is 100 and the passing marks is decided by IBPS that is likely to change every year depending on the level of difficulty of the exam.

| S.No. | Name of Tests(Objective | No. of Questions | Maximum Marks | Duration |

|---|---|---|---|---|

| 1 | English Language | 30 | 30 | 20 minutes |

| 2 | Numerical Ability | 35 | 35 | 20 minutes |

| 3 | Reasoning Ability | 35 | 35 | 20 minutes |

| Total | 100 | 100 | Composite time of 1 Hour | |

Candidates have to qualify in each of the three tests by securing minimum cut-off marks to be decided by IBPS. Adequate number of candidates in each category as decided by IBPS depending upon requirements will be shortlisted for Online Main Examination.

Phase-2: IBPS Clerk Mains Examination

Major changes have been observed in the Exam Pattern of IBPS Clerk 2020-21 Exam. IBPS Clerk Mains Exam will now constitute of 190 questions that needs to be completed in a time frame of 160 minutes.

Previously, Computer Aptitude and Reasoning Ability Section used to be conducted separately. But, in the recent update by IBPS, both these sections are amalgamated together and will constitute of 50 questions that needs to be solved in a time duration of 45 minutes. Both Preliminary Exam and Mains Exam will be conducted bilingually, i.e. both in English and in Hindi. Let’s have a look at the Exam Pattern for IBPS Clerk CWE VIII.

| S.No. | Name of Tests(Objective | No. of Questions | Maximum Marks | Duration |

|---|---|---|---|---|

| 1 | Reasoning Ability & Computer Aptitude | 50 | 60 | 45 minutes |

| 2 | English Language | 40 | 40 | 35 minutes |

| 3 | Quantitative Aptitude | 50 | 50 | 45 minutes |

| 4 | General/ Financial Awareness | 50 | 50 | 35 minutes |

| Total | 190 | 200 | 160 minutes | |

Penalty for Wrong Answers (Applicable to both – Preliminary and Main examination)

There will be penalty for wrong answers marked in the Objective Tests. For each question for which a wrong answer has been given by the candidate one fourth or 0.25 of the marks assigned to that question will be deducted as penalty to arrive at corrected score. If a question is left blank, i.e. no answer is marked by the candidate, there will be no penalty for that question

Final Score Calculation for IBPS Clerk Exam:

There are certain important points on the basis of which the final score for the IBPS Clerk exam is calculated:

• Marks scored in the Preliminary Exam (Tier-1) will not be considered in the final score. These are only taken into account to qualify Mains Exam (Tier-2).

• Candidates need to qualify Phase-2 and Interview individually to be eligible for final worth.

• The aggregate of 100 marks is used for the final merit list for each category. Candidates with high merit rank in each category are finally selected.

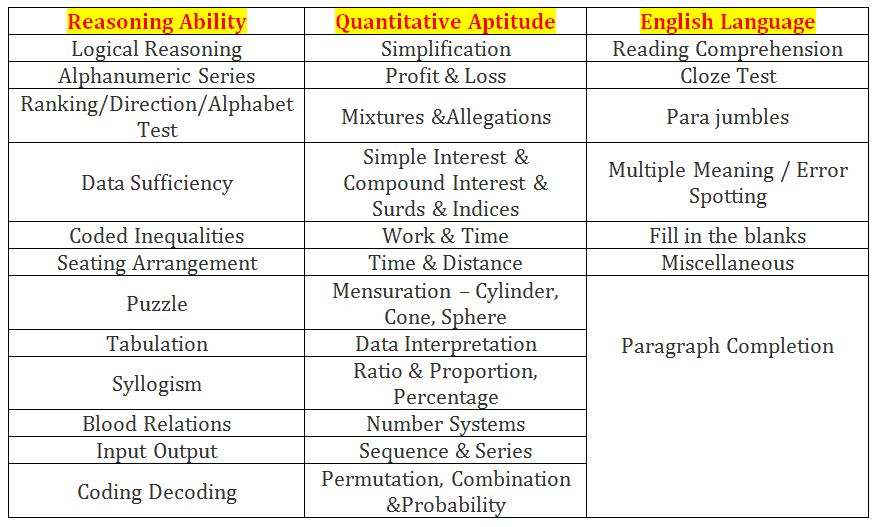

IBPS Clerk Prelims Exam Syllabus 2020-21

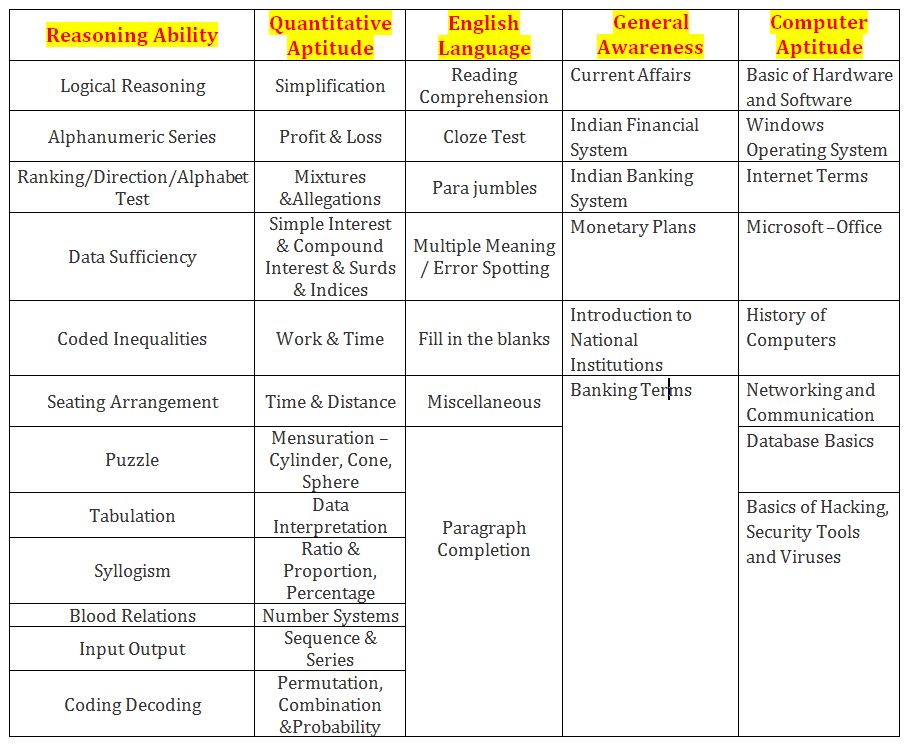

IBPS Clerk Mains Exam Syllabus 2020-21

Banking Prospectus

Click here for Study Material and List of Books: